One of my favourite books, both as a child and now as an adult, is Norton Juster's The Phantom Tollbooth. It is a type of Pilgrim's Progress for children, telling the story of Milo, who had loads of toys, but was always bored. One day he receives a present, a toll booth (not an easy concept for English children until the M6 toll but work with me), and being bored, he decides to play with it, passing through the toll booth to another world where words and numbers are more real.

One of the characters he meets on his journey (he has a quest to rescue Rhyme and Reason from the Demons of Ignorance), is the Average Man, who is tall, short, fat or thin, depending on your point of view. Another is Alec the 0.4 child in an average family with 2.4 children (he has sole use of the .3 of a car as the average family has 1.3 cars). A key message throughout the book is that it all depends on how you look at things.

The FTSE and the other stock markets have been having an exciting August (the Daily Telegraph's Alex cartoon puts this down to too many managers taking their Blackberries on holiday with them), which is not normal. Much has been written about the slump and the problems for pension funds. No doubt there is indeed an underlying issue with unsecured loans in the States, but the reactions to the FTSE levels have been hysterical in my view.

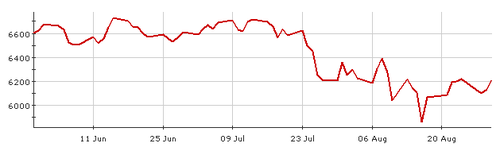

Over the past 3 months, there has indeed been a fall in the FTSE closing price as you can see in the graph from the BBC below.

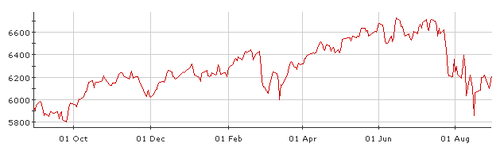

This seems like a terrifying drop until you consider where the FTSE was just a few months further ago than that, as in the 12 month history of FTSE closing prices again from the BBC shown below.

The scarier point on this graph to me is the over inflation of the FTSE around June time, but in the Autumn of last year, the index was consistently below 6000. I could panic about any investments I might have or I could take the long term view - it all depends on how you look at things!